Market Insights & Analysis: GCC Financial Cards & Payments Market (2023-28)

The GCC Financial Cards & Payments Market analysis by MarkNtel Advisors, encompasses the factors that will impact the market's performance during the forecast period, 2023-28. It offers a comprehensive examination of the value chain, supply chain, and business operations in different regional markets. Additionally, it includes a list of reputable companies operating in the market, along with descriptions of their product offerings, to reinforce the research study's credibility.

Request Sample Report For More Detailed Insight: https://www.marknteladvisors.com/query/request-sample/gcc-financial-cards-payments-market.html

Market Dynamics

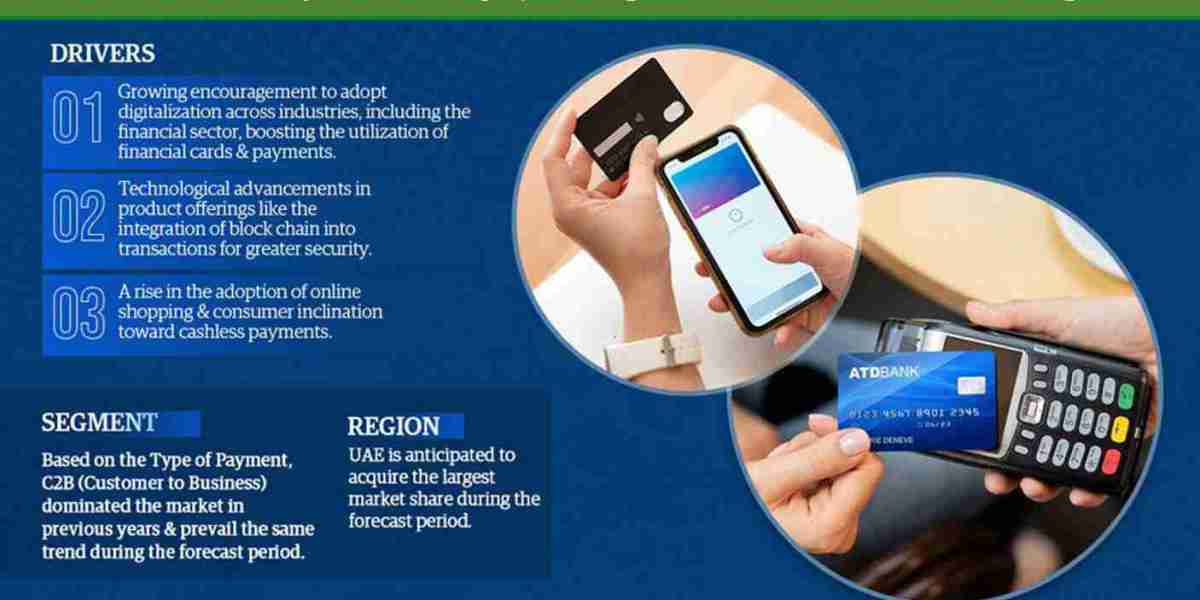

Key Driver:

Expanding E-commerce Industry Across the Region

The growing e-commerce industry across the GCC region has well-supported the financial cards and payments market in the historical years. The countries, such as the UAE, Saudi Arabia, Qatar, etc., have witnessed a significant surge in online retail sales due to high investments by the global retail players in the lucrative market GCC. For instance, in 2020, Carrefour and Lulu Group, two of the largest retailers in the Middle East, launched their online shopping portals in the UAE. The countries, including the UAE, Qatar, Kuwait, and Bahrain have almost 100% of the population with internet and mobile phone access.

Market Key Players

This report delves into the current market trends influencing its growth. It provides insights into essential factors such as market drivers, challenges, and opportunities for key industry players, stakeholders, and emerging competitors. The report profiles leading companies, including

-Visa

-Mastercard

-American Express

-Citibank

-HSBC

-PayPal express checkout

-HDFC Bank

-Diners Club

-Barclays

-Hyperpay

-Others.

View Full Report with TOC & List of Figure: https://www.marknteladvisors.com/research-library/gcc-financial-cards-payments-market.html

Segment Analysis:

For a deeper understanding, specialists have conducted a comprehensive analysis of each category within these segments. This in-depth examination aids industry participants and stakeholders in comprehending the market categories experiencing rapid growth and generating the highest revenue. The accuracy of revenue estimates and computations is ensured through segment-wise expansion.

By Type of Card

-Credit Card

-Debit Card

-Charge Card

-Prepaid Card

By Type of Payments

-B2B

-B2C

-C2C

-C2B

-E-Commerce Shopping

-Payments at POS Terminals

-Others

By Type of Transactions

-Domestic

-Foreign

By Card Issuing Institution

-Banking

-Non-Banking

Industry experts have extensively assessed the profitability and growth potential within these segments. Furthermore, the report examines key geographical regions, including

By Country

-Saudi Arabia

-The UAE

-Qatar

-Bahrain

-Kuwait

-Oman.

providing insights into their growth prospects. The research component also offers sales and revenue forecasts for the period 2023-28, considering factors like sales, pricing, and revenue.

Submitted your request for a custom report- https://www.marknteladvisors.com/query/request-customization/gcc-financial-cards-payments-market.html

Key questions Answered in this Recent Research Report, 2028

- What is the anticipated demand for various product categories, and what are the potential market and industrial applications for these products?

- How are the forecasts for the GCC Financial Cards & Payments Market determined, taking into account factors like production, capacity, production value, expected expenses, profitability, market share, supply, consumption, import/export patterns, and other dynamics?

- Who are the dominant players in the GCC Financial Cards & Payments Market, and which companies currently hold the top positions in the industry?

- What are the notable market trends that can be harnessed to create new sources of revenue?

- What strategies are advisable for entering the market, minimizing economic impact, and selecting effective marketing channels within the GCC Financial Cards & Payments Market?

MarkNtel Advisors is deeply committed to delivering top-tier market research, and this report exemplifies our dedication to providing clients with comprehensive and valuable insights. In response to the release of this report, our analysts remarked, "The GCC Financial Cards & Payments market is undergoing rapid transformations, and remaining ahead of the curve is imperative for businesses and investors. Our report delivers an intricate analysis of market players, opportunities, and insights, equipping our clients with the knowledge necessary for making informed decisions in this ever-evolving landscape.”

About Us-

MarkNtel Advisors is a leading research, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Call: ? +1 628 895 8081, +91 120 4278433

Email: ? sales@marknteladvisors.com

Visit to know more: ? https://www.marknteladvisors.com/

Follow MarkNtel for Latest Update⬇️

✔️ https://twitter.com/markntel

✔️https://in.linkedin.com/company/markntel-advisors